I also notice that the return rate for for this product is less than 5%. That tells me that customers are overwhelmingly happy with the product, and the supplier quality is on point. However, this is a useful piece of data to use when negotiating with my supplier. I will probably ask my supplier for 5% more units in the extraordinary items under gaap next shipment, free of charge, to cover quality-related returns. This way they can help not only file your taxes, but also set up the necessary goals, objectives, systems, and provide proactive insights to key tax-savings strategies. For example, if you notice a big surge in new sales in the month of July, you’ll want to lean in and figure out what caused that.

These extended payment terms put time and money back on your side to continue growing your business in today’s hypercompetitive market. The disadvantages are it typically costs more, longer onboarding ramp-up, and management time. Depending on the experience level you need, the scope of work, and where you hire, you can expect to pay between $10 ma clarifies 2020 tax treatment of ppp income eidl grants and sba debt relief subsidies – $40 per hour for a bookkeeper. This doesn’t account for all of the additional expenses incurred with full-time employees, like payroll taxes, paid sick leave, benefits, etc.

- For example, if you notice a big surge in new sales in the month of July, you’ll want to lean in and figure out what caused that.

- You may want to do this more often if your business is prone to volatility or you are in uncertain times – like a global recession and pandemic.

- Unlike your P&L and balance sheet, it is a more hands-on report where you can model best-case, moderate, and worst-case scenarios.

- Our task is to improve the experience of our customers, staff, and sellers.

Treasury/Risk Management

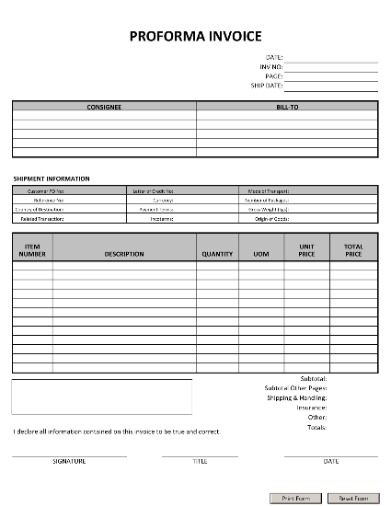

If you were to report the entire lump sum as “sales,” you risk over- or under-reporting your revenue. This can lead to over- or under-paying taxes, and then result in inaccurate data about your business performance. Properly categorizing each component of the settlement ensures compliance, accurate financial reporting, and a clear understanding of your business’s true financial health. If you can’t afford a full-time, in-house accountant or simply don’t want to deal with the management time, using a turnkey, specialist ecommerce accountant or accounting firm like Bean Ninjas can be a great alternative.

We help our customers with cost control, financial planning, and strategy. We work with our brands and businesses to optimize their financial goals. We provide support to leadership in finance planning, analysis, and reporting. We handle corporate accounting, product launches, retail, and special projects. Here is an example structure of simple Cash Flow statement for an FBA business.

What’s the difference between accounting and bookkeeping?

However, occasionally one of your bank feeds might have an outage or some transactions go unaccounted for. The reality is you are setting yourself up for all kinds of financial reporting, compliance issues, and cash flow problems with this laissez faire approach. A sibling to the Profit and Loss Statement, the Balance Sheet is another what is accounts payable definition process and examples favorite financial statement among business executives. The top section of every P&L statement is “Revenue.” I selected a relevant date range to give us a nice clean comparison of this example product in June and July. The first thing I notice is that the business grew by over $4000 from June to July! Clearly, demand for this product is growing, so it might be time to contact the supplier and boost production to avoid an inventory stockout.

When you know your numbers, this allows you to see what’s working, capitalize on any early trends, and drive business growth. A2X’s COGS feature is designed to help sellers better understand their gross profit margin (sales minus COGS). Accounting for the cost of inventory when it is sold provides a more accurate view on business profitability. Proper accrual accounting requires revenue to be recognized when it is earned, regardless of when the payment is received. This means you should record sales that occurred in August within August and sales from September within September.

Myth 2: If you DIY your bookkeeping with Amazon’s default reports and an Excel spreadsheet, you’ll save money.

Finally, we all know that dealing with expense reports is one of the biggest pain points for small businesses. This is especially true for businesses that allow employees to use personal payment methods due to lack of business alternatives. It is crucial to get a clear picture of your spending to better manage budgets. Pay by Invoice also offers no upfront fees and no interest (unlike credit cards), giving you buying power and helping you manage your working capital. With a Business Prime membership, you can apply for 45-day terms with the Small and Medium plans.

A cash flow forecast is a tool you can use to better plan for the future. Your P&L is a report that allows you to quickly see all of your revenue and expenses in a given time period. In addition to doing your taxes, you need to have accurate bookkeeping records.