By following these simple tips, your clients’ payroll records will always be accurate and up to date. Fortunately, there are a few simple ways to stay on top of your payroll duties. The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work what is inventory meaning definition examples as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed. Many business owners aren’t aware of how much it costs to operate their business.

Purchase receipts should always be kept as proof that the purchases took place. Bookkeepers need to frequently report back to management, get their feedback, and work as per their instructions. They should immediately inform management or business owners when there’s something wrong with the company’s financial health. Nowadays, a company’s bank feeds can be easily managed by logging in to a mobile app. So, it is simpler for bookkeepers to check bank statements in real-time and daily reconcile bank statements.

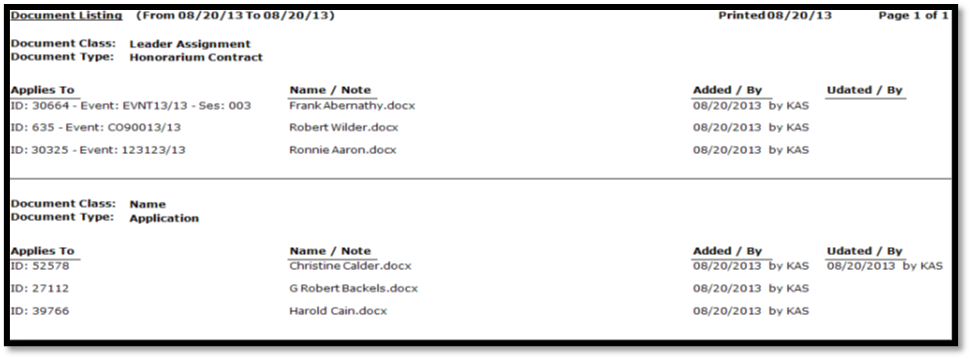

Bookkeeping beginners need quick wins to get started quickly and efficiently. The tips below are industry standards that will help any small business excel at bookkeeping. Below, you’ll see the components of different checklists, plus links to download them for free.

Payroll Register Template

This is particularly true once the business accounts for its operational costs and recurring expenses. Once you’ve got a handle on how to begin bookkeeping for your small business, it’s time to set yourself up for success with an ongoing bookkeeping system. If your business deals with foreign currency, your bookkeeper has to maintain an accurate foreign currency account based on the current exchange rate. A bookkeeper has to establish an open communication environment for colleagues and clients.

- This feature helps prioritize activities, avoid delays, and ensure you complete all bookkeeping tasks on time.

- For related templates, including those for reconciling petty cash and general ledger accounts, see our collection of free reconciliation templates.

- It’s helpful to create income statements because they compare the current numbers to the budget, but also the historical performance of the business.

- There are numerous systems online for scanning, managing, and organizing receipts.

Best Practices to Maintain the Checklist Above

If your business is still small, you may opt for cash-basis accounting. If you carry inventory or have accounts payable and accounts receivable, you’ll likely use accrual accounting. Accrual accounting provides a more accurate picture of a business’s financial health than cash accounting, as it considers all of the financial transactions for a given period. This accounting method is useful for businesses with inventory or accounts payable and receivable. Bookkeeping is how businesses, entrepreneurs, and decision-makers monitor a company’s overall financial health and activity.

Free Template – Bookkeeping Checklist

Also, well-documented and organized receipts can significantly help what is freight on board fob check out our glossary during audits. There are several effective ways to manage bookkeeping responsibilities in-house or externally by using helpful tools and technologies. Although bookkeeping is an investment, it’s generally much more affordable than attempting to correct costly mistakes down the road.

For example, if you know your client only has a certain amount of cash on hand, you can be more careful about how it is spent. Maintaining financial allocating account dollars records requires a high degree of accuracy and attention to detail. Additionally, be sure to update your records regularly so you can catch any errors. Lastly, keep a copy of each employee’s most recent pay stubs on hand so you can reference them if any questions arise.

Taking stock of your company’s performance and health is essential for further planning and strategizing, so you must ensure the data presented is accurate. However, you can often negotiate longer terms if your company is short on cash. Spending a little time on this task daily is easy and eliminates a grueling month-end chore. It’s also a good time to review pending transactions for errors or abnormalities, allowing you to investigate potential issues promptly.

Despite the importance of accurate bookkeeping practices, most people don’t feel entirely confident with maintaining detailed business finances. Whether it’s a lack of interest or knowledge, many businesses outsource this process to a professional bookkeeper to ensure accurate and healthy finances all around. Financial Cents offers a user-friendly interface for efficiently managing your firm’s bookkeeping workflow. With features like workflow automation, due date tracking, and task dependencies, you can streamline your accounting processes, save time, and ensure timely completion of tasks. Every business needs a bookkeeping checklist to organize financial records and ensure smooth operations. Completing these tasks throughout the year can help keep your business on the right path.